Welcome

to the Investor Relations page of Peach Property Group AG. Here you will find all information and current announcements about our key figures, our stock, and corporate governance. Do you have any further questions? Do not hesitate to contact us.

Share

Statement June 30, 2025

| Name | Peach Property Group AG |

| ISIN | CH0118530366 |

| WKN | A1C8PJ |

| Stock Martet Symbol | PEAN (Bloomberg und Reuters) |

| Industry | Real Estate |

| Market Segment | SIX Swiss Exchange |

| Share Type | Registered Shares |

| Number of Shares | 45,470,129 (of which 410 treasury shares) |

| Share Capital | CHF 45,567,454 |

| Initial Listing | 12. November 2010 |

Reports and Events

Announcements

Ad-hoc News

Corporate News

The disclosure regulations for management transactions require that members of the board of directors and management of listed companies publish transactions with shares and other financial instruments of the company to SIX Exchange Regulation.

On the website of the Swiss Exchange you will find the publication of trading notifications with securities of Peach Property Group AG. Enter the name “Peach Property Group AG” in the “Issuer” search field.

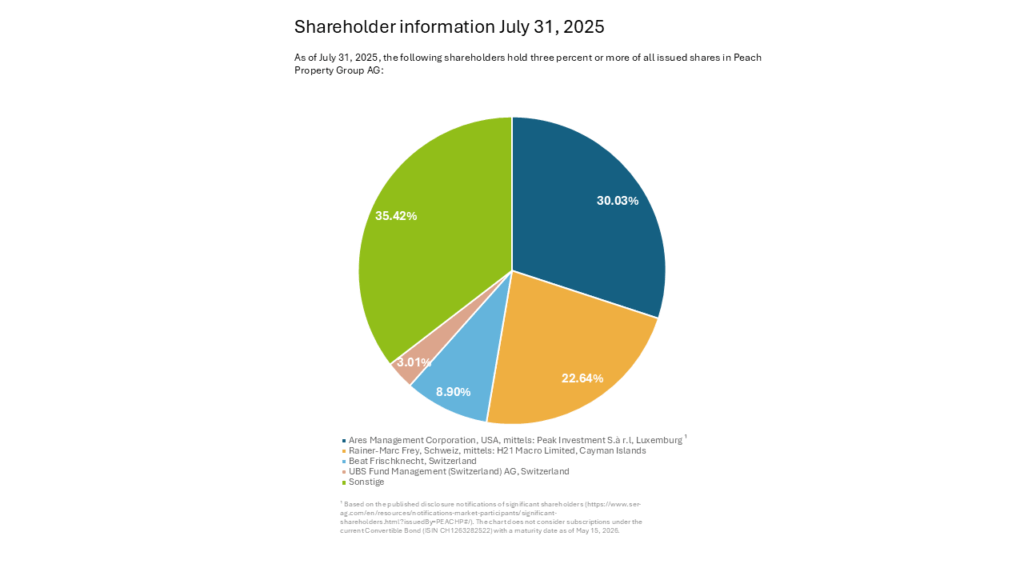

All information on notifications of shareholdings to SIX Exchange Regulation can be found at this link.

Corporate Governance & Shareholders’ Meeting

Information about our Board of Directors and Executive Management can be found here.

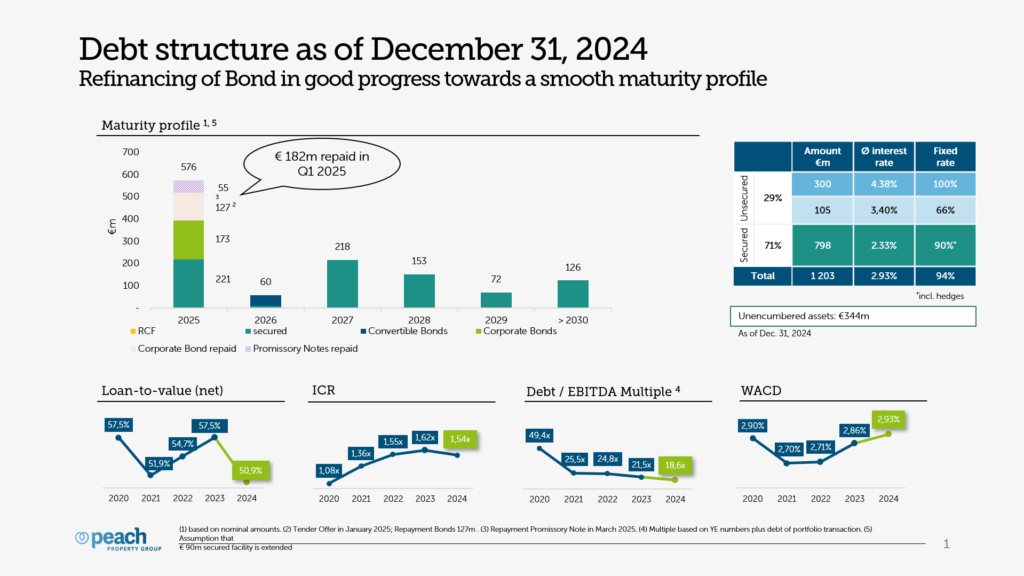

Creditor Relations

Bond Facts

Convertible bond (Swiss standalone prospectus) with nominal amount of CHF 50 million

(with the possibility to increase up to CHF 65’000’000).

11853036 / CH0118530366 (Shares)

Prospectus, dated 21 March 2023: Download

Supplement to prospectus, dated 11 April 2023: Download

Bond facts

Corporate Bond (144A/Reg S) with a nominal amount of EUR 300 Mio.

Bond facts

Perpetual Hybrid Warrant Bond of CHF 50 Million with an option to increase to CHF 100 Million.

Services and Contact

Investor Relations

Email: investors@peachproperty.com

Peach Property Group AG

Neptunstrasse 96

8032 Zürich

Schweiz

Share Register

For matters concerning the registration of your shares, as well as any changes to your name or address, please contact our share registrar directly.

Computershare Schweiz AG

Peach Property Group AG

Postfach

4601 Olten

Email: share.register@computershare.ch

Tel.: +41 62 205 77 00

Fax: +41 62 205 77 90

Glossar

The gross return corresponds to the target rental income from letting less lost income due to vacancies in rela- tion to the average value of the portfolio.

Estimated Market Rental Value (ERV) of vacant space divided by ERV of the whole portfolio.

Represents the shareholders’ value under a disposal scenario, where deferred tax, financial instruments and certain other adjustments are calculated to the full extent of their liability, net of any resulting tax.

Assumes that entities never sell assets and aims to represent the value required to rebuild the entity.